20th, Aug, 2025

Top Paint Companies Q1 Performance Report (FY25-26 Standalone)

India’s Paint Industry in FY26

India’s paint industry is a vital segment of the construction and home improvement ecosystem, driven by demand from both decorative and industrial paints. The Q1 FY26 (April–June 2025) performance reflects a mixed growth trend across major players, with revenue stability but profitability pressures due to rising costs and subdued demand.

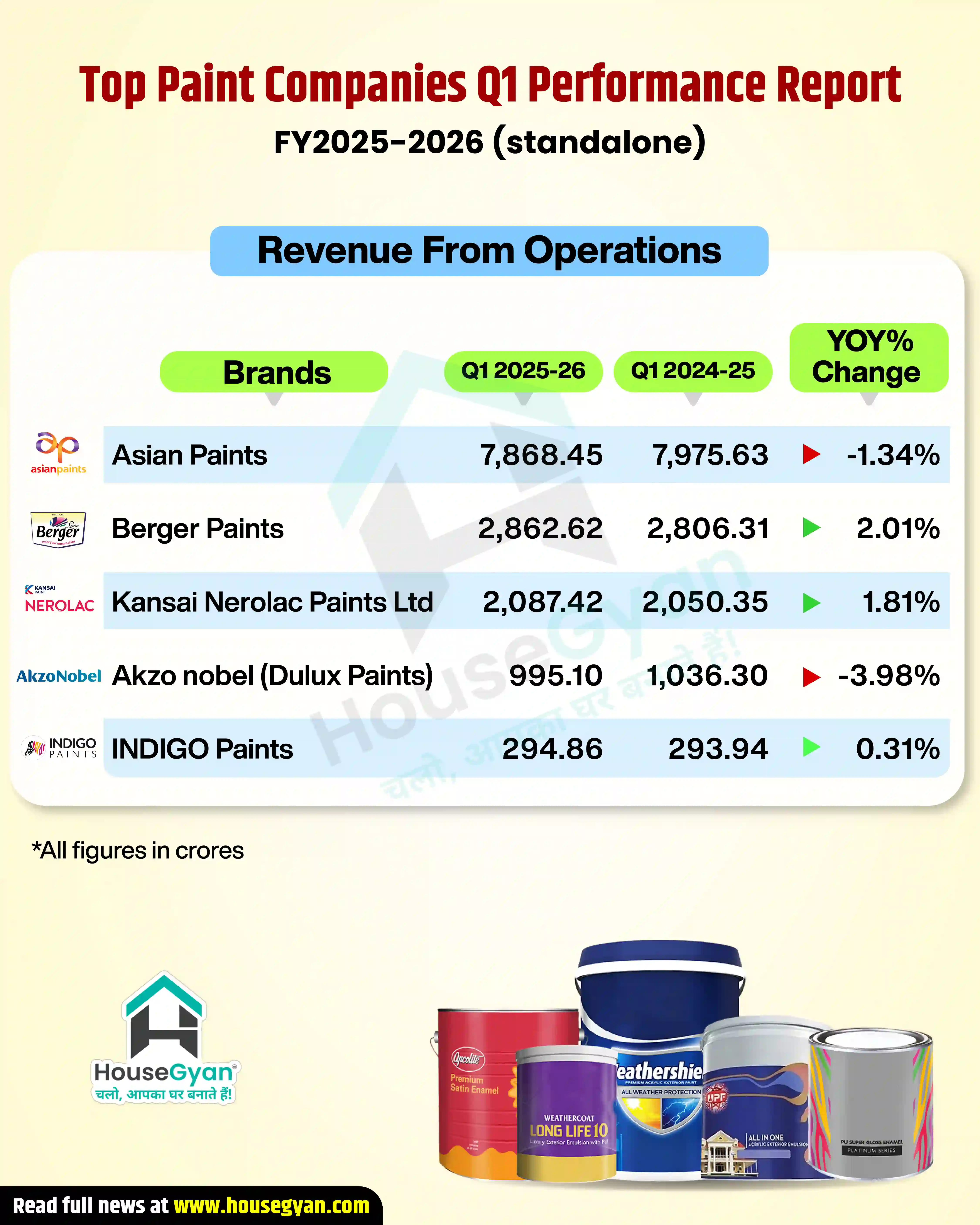

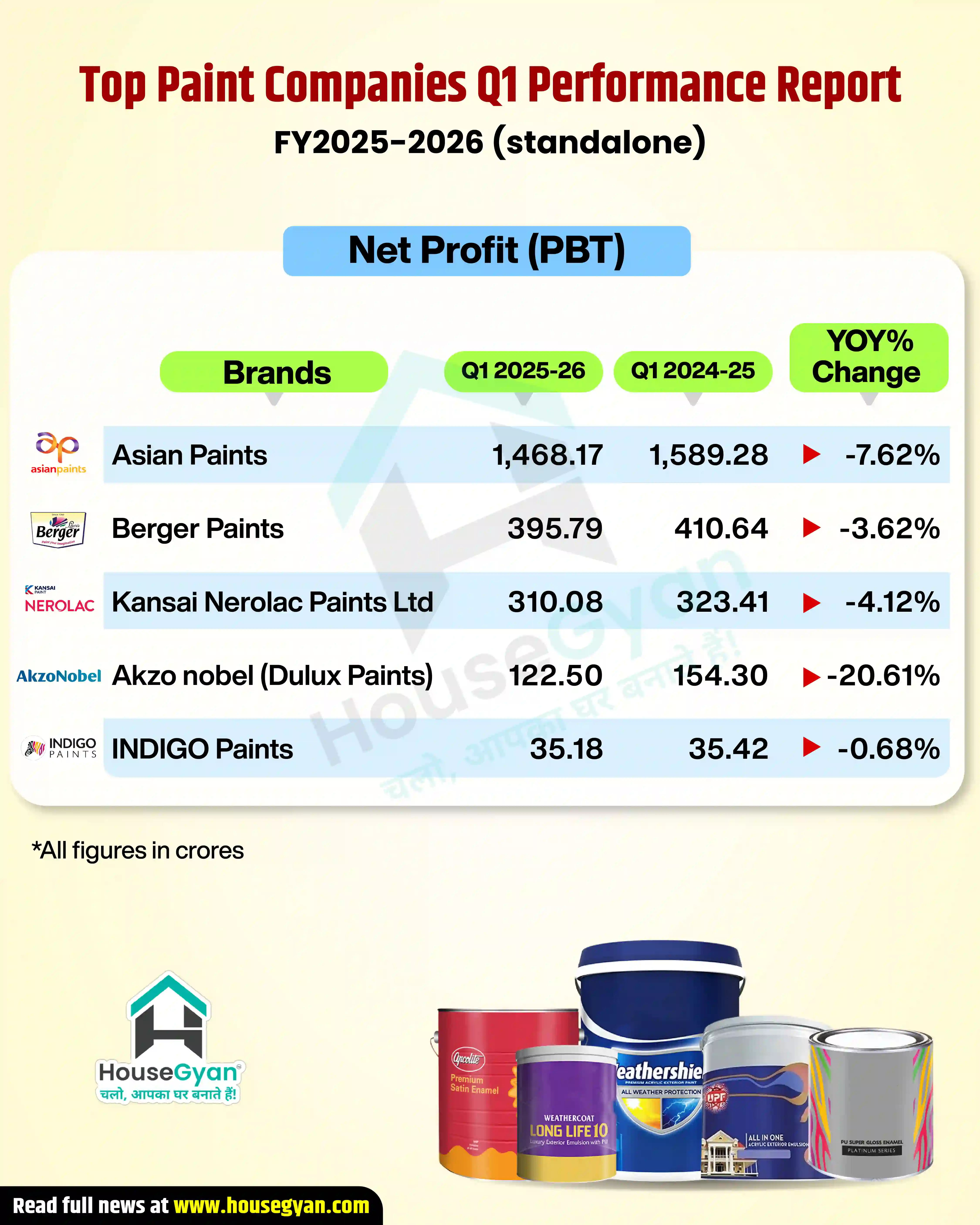

Paint Companies Q1 FY26 Standalone Financial Report

Asian Paints – Market Leader Faces Decline

Asian Paints, India’s largest paint company, reported revenues of ₹7,868.45 Crores, a -1.34% decline YoY. Profits also fell by -7.62%, impacted by higher raw material costs and softer demand. Despite this, it remains the clear market leader.

Berger Paints – Modest Growth, Profit Pressure

Berger Paints achieved 2.01% revenue growth at ₹2,862.62 Crores. However, profits dipped -3.62% YoY due to input cost pressures. Its growth in decorative paints continues to support top-line expansion.

Kansai Nerolac – Stable Revenue, Lower Profit

Kansai Nerolac posted revenues of ₹2,087.42 Crores (+1.81%), but profitability declined by -4.12% YoY. While decorative demand remains steady, industrial paint demand showed slower momentum.

Akzo Nobel (Dulux Paints) – Struggling with Profitability

Akzo Nobel’s revenues slipped -3.98% YoY, to ₹995.10 Crores. More concerning is its profit decline of -20.61%, reflecting margin pressures and stiff competition.

Indigo Paints – Flat Performance

Indigo Paints reported marginal revenue growth (+0.31%), with revenues of ₹294.86 Crores. Profit remained almost flat, slipping -0.68% YoY. The company continues to expand its regional presence but faces strong competitive headwinds.

Comparative Analysis – Revenue vs Profit Trends

Revenue Growth Across Companies

Growth Leaders: Berger Paints (+2.01%), Kansai Nerolac (+1.81%)

Marginal Growth: Indigo Paints (+0.31%)

Decliners: Asian Paints (-1.34%), Akzo Nobel (-3.98%)

Profitability Challenges

Sharpest Decline: Akzo Nobel (-20.61%)

Moderate Declines: Asian Paints (-7.62%), Berger Paints (-3.62%), Kansai Nerolac (-4.12%)

Flat: Indigo Paints (-0.68%)

Key Factors Influencing Paint Industry Performance in FY26

Raw Material Cost Pressures

Crude oil derivatives, pigments, and solvents saw cost fluctuations, impacting margins across companies.

Seasonal Demand Shifts

Pre-festive demand was delayed, affecting Q1 sales volumes. Rural demand recovery also remained subdued.

Competitive Pricing & Market Share Dynamics

Price wars among leading players to capture market share exerted downward pressure on margins.

Impact of Infrastructure and Housing Growth

Urban housing and commercial real estate demand continue to support long-term industry prospects.

Strategic Takeaways for Investors & Stakeholders

Leaders to Watch: Asian Paints remains the market leader, though short-term pressures exist.

Emerging Players: Berger Paints and Kansai Nerolac posted modest revenue growth.

Under Pressure: Akzo Nobel showed steep profit declines; Indigo Paints remained stagnant.

Future Outlook – Paint Industry in FY26

The outlook for FY26 remains cautiously optimistic.

Recovery in housing and construction demand will support revenue growth.

Companies must manage raw material volatility and focus on operational efficiency.

Decorative paints are expected to remain the primary growth driver, supported by urban and semi-urban housing projects.

Conclusion – Mixed Signals for India’s Paint Sector

The Q1 FY26 performance of India’s top paint companies reveals revenue stability but profitability pressures. Asian Paints remains dominant despite a dip, while Berger Paints and Kansai Nerolac showed modest growth. Akzo Nobel faced steep declines, and Indigo Paints delivered flat results.

Looking ahead, housing demand, urban expansion, and infrastructure projects will drive long-term growth, though managing raw material costs will be critical.

House Gyan all services

Loading...HouseGyan is your trusted platform for everything related to home design, construction, and planning. We offer a complete range of services to help you build your dream home with ease and confidence.

Our Services

- Price Calculators: Plan your budget with our tools like Home Loan EMI Calculator, Tile Price Calculator, Brick Cost Calculator, and more.

- House Drawings & Plans: Explore ready-made house plans or get custom house drawings designed to fit your needs perfectly.

- Elevation Designs: Choose from modern elevation designs or request a custom elevation design for a unique look.

- Accurate Estimates: Get clear and accurate construction cost estimates to plan better.

- Shubh Muhurat & Vastu Tips: Follow our Shubh Muhurat and Vastu guidelines to bring positive energy and harmony to your home.

- DIY Home Repair Guides: Learn easy DIY tips to fix and maintain your home efficiently.

- Interior Design Ideas: Discover creative ideas for living rooms, bedrooms, kitchens, balconies, and more.

Why Choose HouseGyan?

- All-in-One Platform: From house plans to price calculators, we cover it all.

- Custom Solutions: Get personalized designs and estimates for your home.

- Expert Guidance: Access professional tips on Vastu, Shubh Muhurat, and construction materials.

- User-Friendly: Our tools and content are designed to simplify home building for everyone.

The information contained on Housegyan.com is provided for general informational purposes only. While we strive to ensure that the content on our website is accurate and current, we make no warranties or representations of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Housegyan.com will not be liable for any loss or damage including, without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Third party logos and marks are registered trademarks of their respective owners. All rights reserved.